[vc_row][vc_column][vc_column_text]

Leading US Credit Card company transforms their CX with Messaging

Le client

This customer is one of the largest credit card companies in the world that enables over 57 million cardholders to spend smarter, manage debt better and save more for a brighter financial future.

Their core values and emphasises on CX, gives voice to their customer-obsession and their drive to constantly discover new ways to provide effortless experiences. Over the years, the company has built a reputation for outstanding CX, having won highly acclaimed awards in the finance space.

Passage à une plateforme moderne de messagerie client

This Finserv customer keeps CX at the front and center of their offering by employing over 8000 customer service agents located across the continental US and available 24×7. These agents handle queries phone and digital channels.

Their first foray into digital customer service was in 2006 when they launched live chat support on the website. Although live chat was well received by their customers, their Director of Digital Customer Service and team felt they could do even better.

« Notre objectif est d’offrir une expérience de service client sans effort à nos consommateurs. Nous y parvenons en les servant via leurs canaux de préférence. S’ils rencontrent un problème, ils peuvent appeler notre ligne téléphonique du centre client. S’ils ne souhaitent pas appeler, ils ont l’option de nous envoyer un message. »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

Customers would go to the website, click on the ‘Chat with us’ option, and wait in a chat queue hoping an agent is available. They could not switch tabs or leave the page as this would mean missing their turn in the queue and having to start over. If the agent was able to resolve a query, a feedback survey would be sent, marking an abrupt end to the customer service experience.

The team sought to improve this experience with a flow that was familiar and intuitive, similar to texting on iMessage, WhatsApp and other messaging applications. They wanted to adopt a contextual and continuous messaging approach.

La réussite avec freshchat

This Finserv company assembled a team to scout for a new partner that will help them to not only scale but to also deliver cutting edge customer experiences.

« Nous avons évalué environ 20 à 30 fournisseurs de chat en direct pour établir un partenariat sur les 5 à 10 prochaines années dans notre parcours d’expérience client avant de choisir Freshchat. »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

During their evaluation, they wanted improvements from three perspectives – the customer, the agent, and the business.

Offrir des expériences client intuitives

This Finserv company’s legacy live chat solution restricted chat to purely website support. In addition to this, using session-based live chat meant that conversation history would be lost after each session and agents would be unable to access any information that had been provided to them.

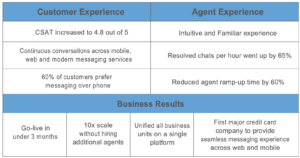

With Freshchat, this leading credit card provider upgraded from live chat to modern messaging not only on their website, but also on their mobile app using Freshchat’s robust mobile SDK. They also extended their customer service on iMessage using Freshchat’s native integration with Apple Business Chat.

Customers are now able to shift from web support to mobile support seamlessly without having to restart their conversation.

The continuous messaging style of Freshchat allows agents to maintain context of past issues the customer has faced, and lets them provide a personalized experience.

« La messagerie est différente du chat en direct traditionnel. C’est comme avec les amis et la famille. C’est persistant et c’est pour toujours. Les clients se tournent vers ces canaux de préférence pour interagir avec les marques – Apple Business Chat, WhatsApp, Facebook Messenger ou via notre application mobile.

Les clients nous ont dit que c’est comme avoir le service client dans leur poche, tout l’historique des messages et le contexte sont là – c’est persistant et familier. »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

Améliorer l’expérience des agents

This Finserv company’s evaluation team was convinced that a solid agent platform was one of the most important factors in selecting a messaging partner. According to them, customers are not the only end users, but also the 8,000 member support team who use the platform everyday to create moments of delight.

They wanted to give their agents a familiar and intuitive interface that would allow them to focus their energy on the customer, and not on complex, clunky software.

« Nos agents utilisent Gmail, Twitter, Facebook dans leur vie personnelle – mais les plateformes de chat d’entreprise ont ces interfaces complexes et compliquées qui les rendent difficiles à utiliser. Nous avions besoin d’un outil avec lequel nos agents seraient à l’aise et qu’ils aimeraient utiliser. Freshchat était clairement le gagnant ici ! »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

Freshchat’s modern messaging experience made it easy for the agents straight away. With an interface similar to popular messaging applications like Facebook Messenger & WhatsApp, the learning curve was minimal. To put a number on it, agent training time was reduced by as much as 60%. Agents felt less stressed about using Freshchat’s agent interface and were in turn able to provide a better messaging experience to the end user.

Désencombrer l’entreprise

With the earlier legacy live chat solution, this leading US credit card provider was not able to bring all their business units (BU) under a single chat instance. The live chat widget was not customisable enough to match different brand styles and websites for each business group. More importantly, there was no way to limit access to customer information for different agent groups and maintain data confidentiality between business units. This was not an ideal situation as different BUs were operating in silos without a seamless flow of customer context.

With Freshchat’s advanced roles and permissions feature, this Finserv company unified all their teams under a single Freshchat instance. Now, everyone has context while key customer information is still protected by retaining the right access controls for the right teams. With Roles and Permissions, they were able to create custom roles with very granular access permissions.

Freshchat not only offered the breadth of features that were critical, but also the depth and granularity to make it work for this Finserv’s enterprise requirements.

Mise à l’échelle avec les robots et l’IA

Due to the scale of their operations, this Finserv company felt that being able to bring their own customer-facing chatbots was a critical requirement. Freshchat’s open APIs allow them to build their own customer-facing chatbot and fetch information from other internal systems.

They receive a wide range of customer queries, some of which are easier to respond to than others. A simple question like “What’s my account balance?” requires an agent to switch screens, login to an internal system, retrieve the account information and paste it back in the chat. This process takes around 3 minutes. With Freshchat, the platform makes an API call to fetch the account information and provides instant responses to customers without human intervention.

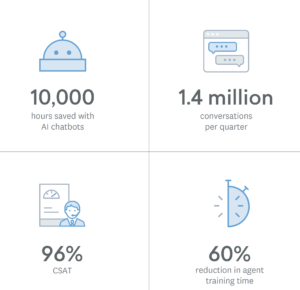

Implementing their Virtual Assistant has had a significant impact already, saving over 10,000 hours of valuable agent time. They leverage bots to solve as many customer enquiries in as little time as possible.

« Les API flexibles de Freshchat nous permettent d’apporter notre propre expérience d’automatisation. Nous avons déployé notre Assistant Virtuel pour répondre aux questions simples. Nous avons un système de score de confiance et si les questions sont trop complexes pour le robot, il transfère automatiquement la conversation à un agent humain avec le contexte et l’historique pour une conversation plus émotive. Ce transfert est extrêmement fluide car le client n’a aucune action à effectuer – tout se passe dans la même fenêtre de chat pour eux »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

Freshchat not only offered the breadth of features that were critical, but also the depth and granularity to make it work for this Finserv’s enterprise requirements.

Résultats tangibles

Incorporating Freshchat on their website and mobile app resulted in improved CSAT, a rise in agent productivity and a significant increase in messaging volumes.

- Cette société de services financiers est reconnue comme la première grande société de cartes de crédit à offrir une expérience client transparente sur le web et mobile.

- Le taux de satisfaction client est passé de 4,6/5 à 4,8/5 en un an après l’implémentation de Freshchat. À l’échelle de 1,4 million de conversations résolues rien qu’au troisième trimestre 2019, cela représente une amélioration significative des performances du chat.

- Le nombre de chats résolus par heure et par agent a régulièrement augmenté de 65 % depuis le début de l’année.

- Ils ont réussi à multiplier par 10 le volume des chats sans avoir à augmenter le nombre d’agents grâce aux robots et à l’IA.

« Une grande partie est due aux optimisations de conception et aux flux dans Freshchat. C’est moderne, intuitif et les agents peuvent travailler beaucoup plus rapidement. Les temps de réponse sont un indicateur clé de la qualité du support et, en fin de compte, une équipe de support plus efficace conduit à une meilleure expérience pour le client. »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

La route à suivre

In order to learn about consumer preferences, this leading credit card provider enabled the ‘click to chat’ feature on iOS. When a customer tries to call the their customer service telephone line, they are prompted to choose between ‘Call’ and ‘Message Us’. 60% of customers chose to message rather than call.

The preference towards messaging also presents a great opportunity for this leading Finserv company to improve agent productivity. A customer service agent is able to handle 5-6 concurrent chats in the same amount of time as it would take them to resolve one phone call. They believe they can do 50% better in terms of agent productivity as messaging as a channel matures further.

« Au sens propre, Freshchat nous permet de fournir une expérience de messagerie ininterrompue en permanence. Eh bien, nous avons connu une croissance de 10x après l’introduction de la messagerie et plus de 60 % de nos clients préfèrent la messagerie pour nous contacter. »

Directeur de l’Expérience Client Numérique, Grande société de services financiers américaine

The writing is on the wall for enterprise brands. Customers are moving away from traditional channels like phone and legacy live chat. They prefer to use messaging that is user-friendly, familiar and available – be it Facebook Messenger, Apple Business Chat or WhatsApp.

This leading US Finserv company wins customers-for-life with Freshchat, one conversation at a time. You can take that to the bank!

Souhaitez-vous en savoir plus ?

[/vc_column_text][dt_default_button link= »url:%23popmake-2995|||rel:nofollow » size= »big » button_alignment= »btn_center » css= ».vc_custom_1591614144243{margin-top: 20px !important;} »]RÉSERVEZ VOTRE CONSULTATION GRATUITE[/dt_default_button][/vc_column][/vc_row]